Cattle And Livestock Transaction Levy

Livestock SA strongly supports the introduction of a cattle transaction levy for all cattle sold in South Australia. In late 2014 a Senate committee recommended Australias grassfed cattle industry establish an automated cattle transaction levy system to identify levy payers against levies paid and to accurately allocate industry voting entitlements.

Red Meat White Paper Where Does Government Stand Beef Central

Producers currently pay a 5 fee for every head of cattle they sell other than the 90 cent bobby calf fee.

Cattle and livestock transaction levy. Cattle and livestock levy payer registers scheduled for July 1 introduction James Nason 21052021 WORK to develop registers of cattle and livestock levy payers is progressing toward a commencement date of 1 July 2021 Meat Livestock Australia says. Using the example of a 05 per cent fee with an 8 cap Mr Quilty said such a system would be more equitable. The maximum duty for any one head of cattle sold singly or as part of a lot is 5.

Cattle livestock transaction levy. Cattle Council of Australia. Under the Federal Levies Order the purchaser or dealer is required to remit the federal levy to the provincial cattle association where the purchaser or livestock dealer resides.

Red meat and livestock industry structure Custodian of MOURed Meat Advisory Council Peak industry councils Service providers Cattle transaction levy Management and investment of marketing and RD levy components MLA funding and revenue. In 2014 Senate committee recommended Australias grassfed cattle industry establish an automated cattle transaction levy system to identify levy payers against levies paid and to accurately allocate industry voting entitlements. Who collects the levy.

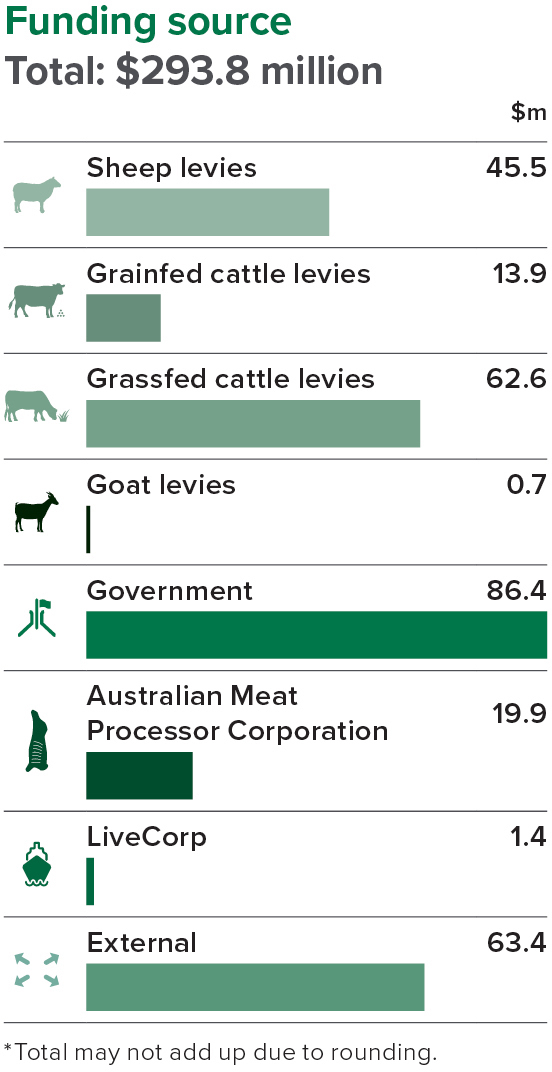

Processors lot feeders and livestock exporters also pay levies. The levies are collected by the Department of Agriculture and Water Resources Levies Service and distributed to MLA Animal Health Australia AHA and the National Residue Survey NRS. 3 Levy on cattle slaughtered by a processor that are referred to in paragraph 4 1 c or d is payable.

Australian Beef Sustainability Framework. The levy return form for Cattle and Livestock PurchasedSoldDelivered is now available for lodgement through Levies Online. Agents can assist with all forms of sales with commission up to 5.

The cattle transaction levy was first introduced 28 December 1990 and the livestock transaction levy was introduced 1 July 1997. 2 Levy on cattle delivered to a processor otherwise than because of a sale to the processor is payable by the person who owned the cattle immediately before the delivery. Cattle sheep and goat producers pay a transaction levy on the sale of their livestock.

The transaction levy on cattle sales should be doubled according to a beef industry leader. If you are selling livestock or their carcasses on your own behalf you must pay duty via a. Saleyard fees range from around 4 to 750 per head.

Duty is five cents 005 for every 20 or part of 20 of the sale price for one head of cattle sold singly or the total amount of the sale price for any number of cattle sold in one lot. Cattle or livestock that are produced in Australia and are sold or transferred between production and processing stages or that are delivered for export by a producer will attract the cattle or livestock transaction levy. 125 of 1990 as made.

The recommendation was publicly supported by wide range of industry bodies and the Federal Government. A livestock dealer licensed in two provinces could depending on the transaction be carrying on business in. Industry is represented by.

Lucinda Corrigan a former Meat and Livestock Australia director and prominent NSW Angus stud breeder said it was time to think about the first levy lift in 15 years. A transaction levy of 5head is paid to Meat Livestock Australia on all cattle sales. The Department of Agriculture - Levies ï preferred method of lodging returns is online as it enables real time accurate processing of returns.

Name of the levy. Meat and Live-stock Industry Legislation Repeal Act 1995. Context of the inquiry Intent of the 199798 reforms.

An Act to impose a levy on certain transactions and other dealings involving cattle. James Nason 13032020. The levy fees go to Animal Health Australia Meat Livestock Australia MLA and the National Residue Survey NRS.

In 2005 cattle producers across Australia voted in favour of increasing their transaction levy by 150 per head sold to bolster the marketing and promotion of beef. Australian Government Department of Agriculture and Water Resources. Duty is payable monthly on the sale of cattle including bulls cows oxen steer heifers bison and buffalo sheep goats or pigs or their carcasses and is charged on a per-head or carcass basis.

Using an agent includes delcredere insurance which guarantees payment.

Where Does My Goat Transaction Levy Go Meat Livestock Australia

About Your Levy Meat Livestock Australia

About Your Levy Meat Livestock Australia

Beef Transaction Levy Calls For First Increase In 15 Years The Weekly Times

About Your Levy Meat Livestock Australia

Commercial Transaction Levy 50cts Uganda 1973 Postal Stamps Stamp Postage Stamps

About Your Levy Meat Livestock Australia

Cattle Levy Register May Be In Place Later This Year Mla Beef Central

Beef Transaction Levy Calls For First Increase In 15 Years The Weekly Times

Post a Comment for "Cattle And Livestock Transaction Levy"